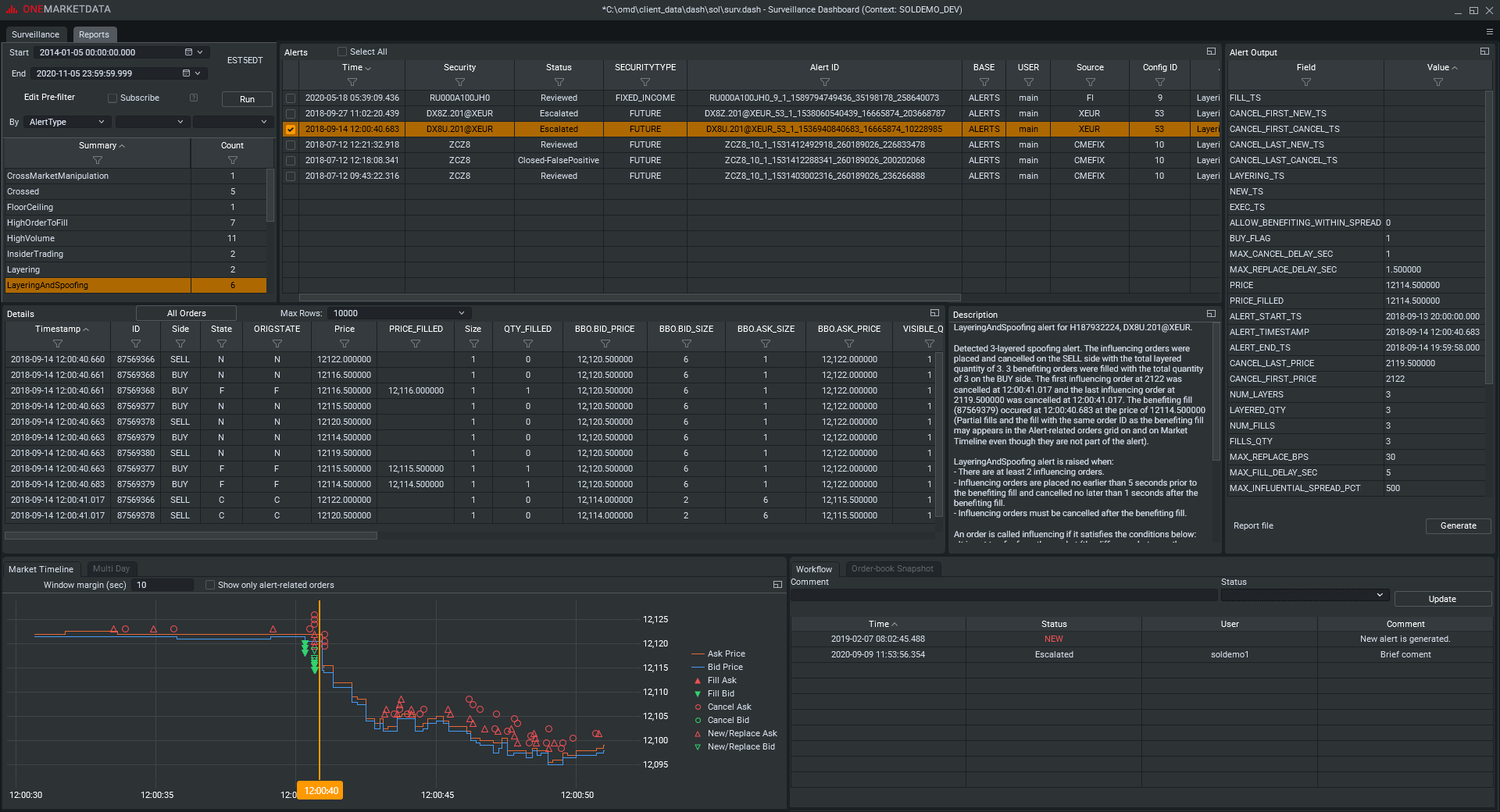

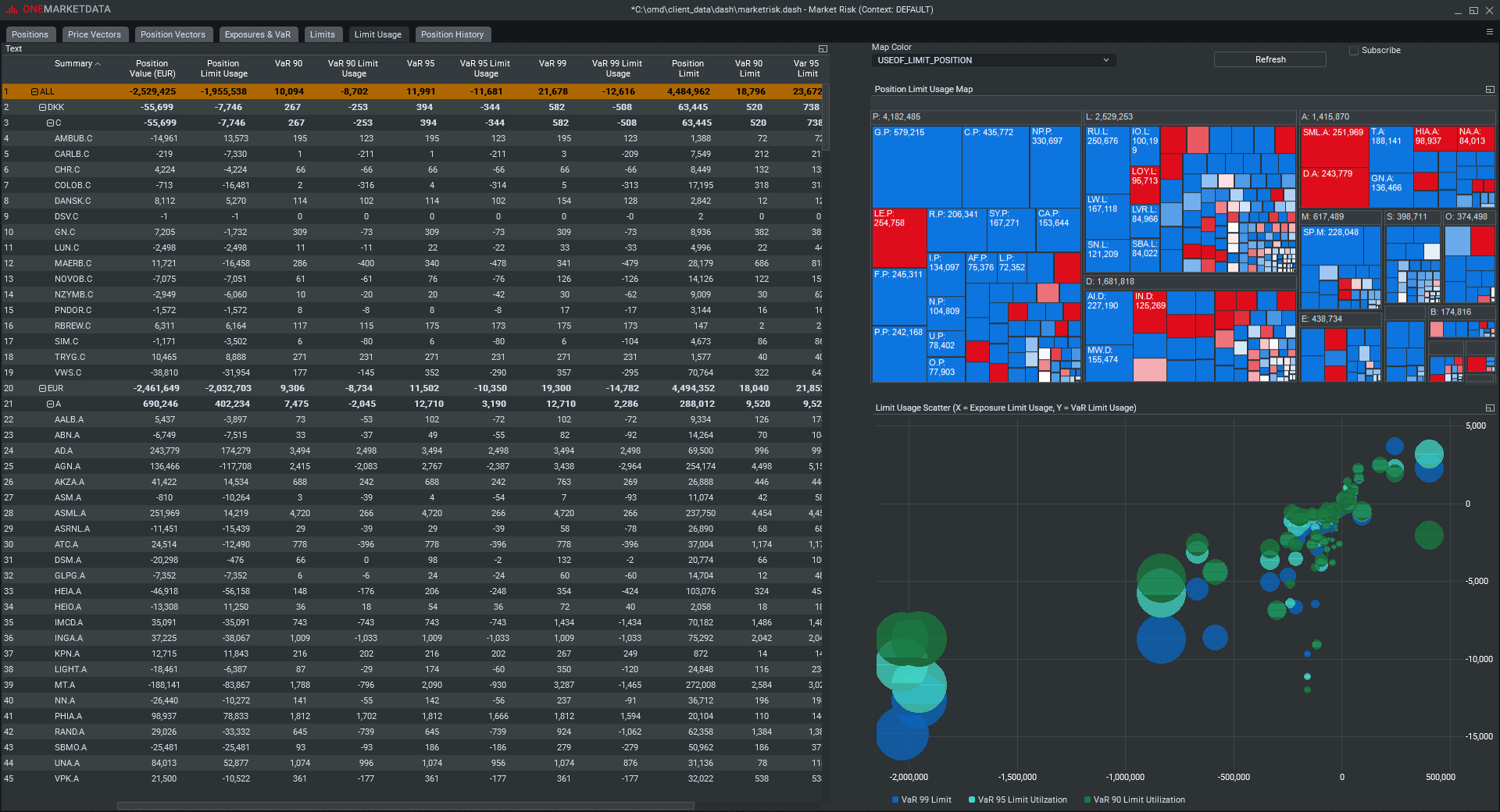

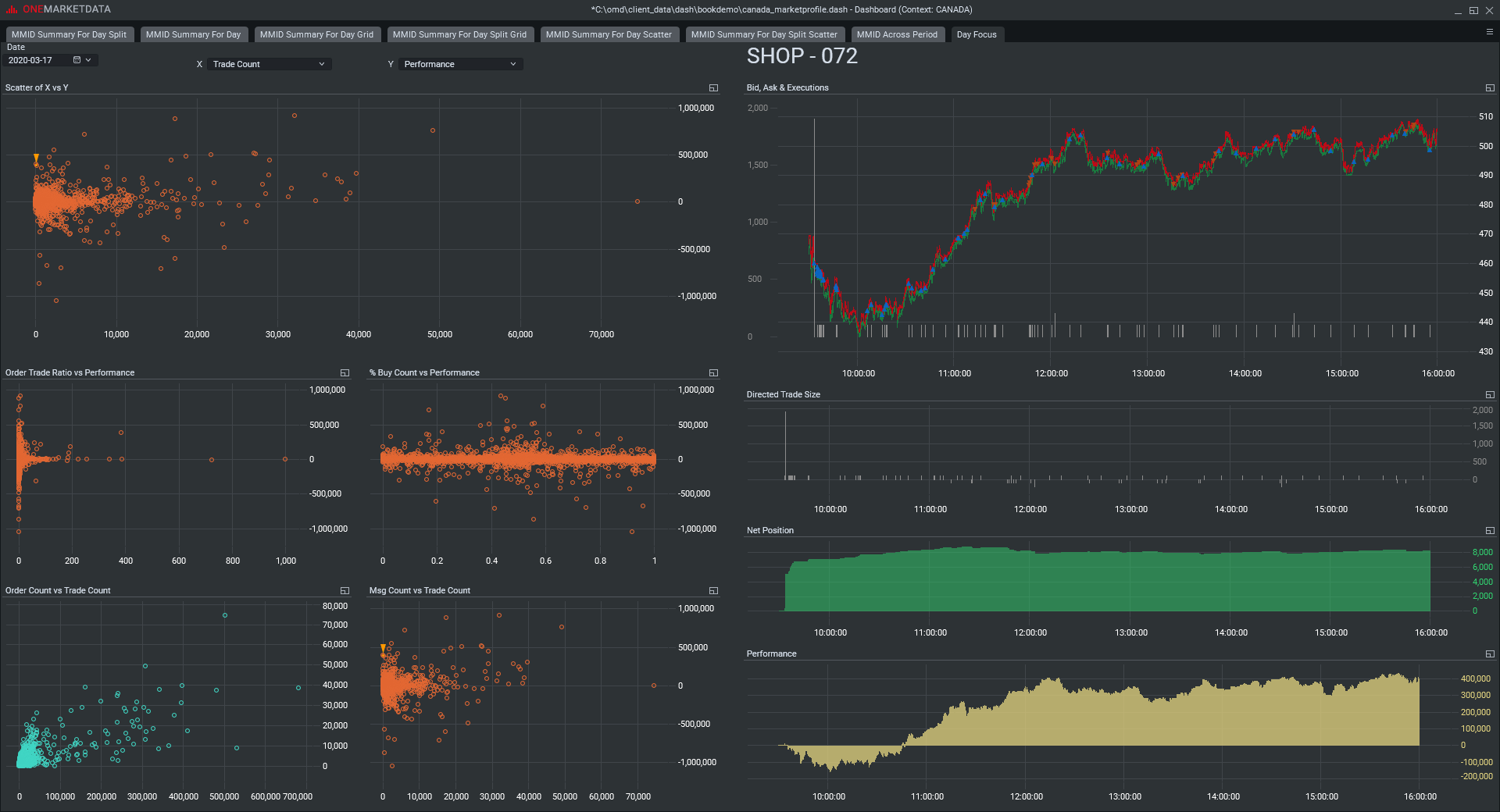

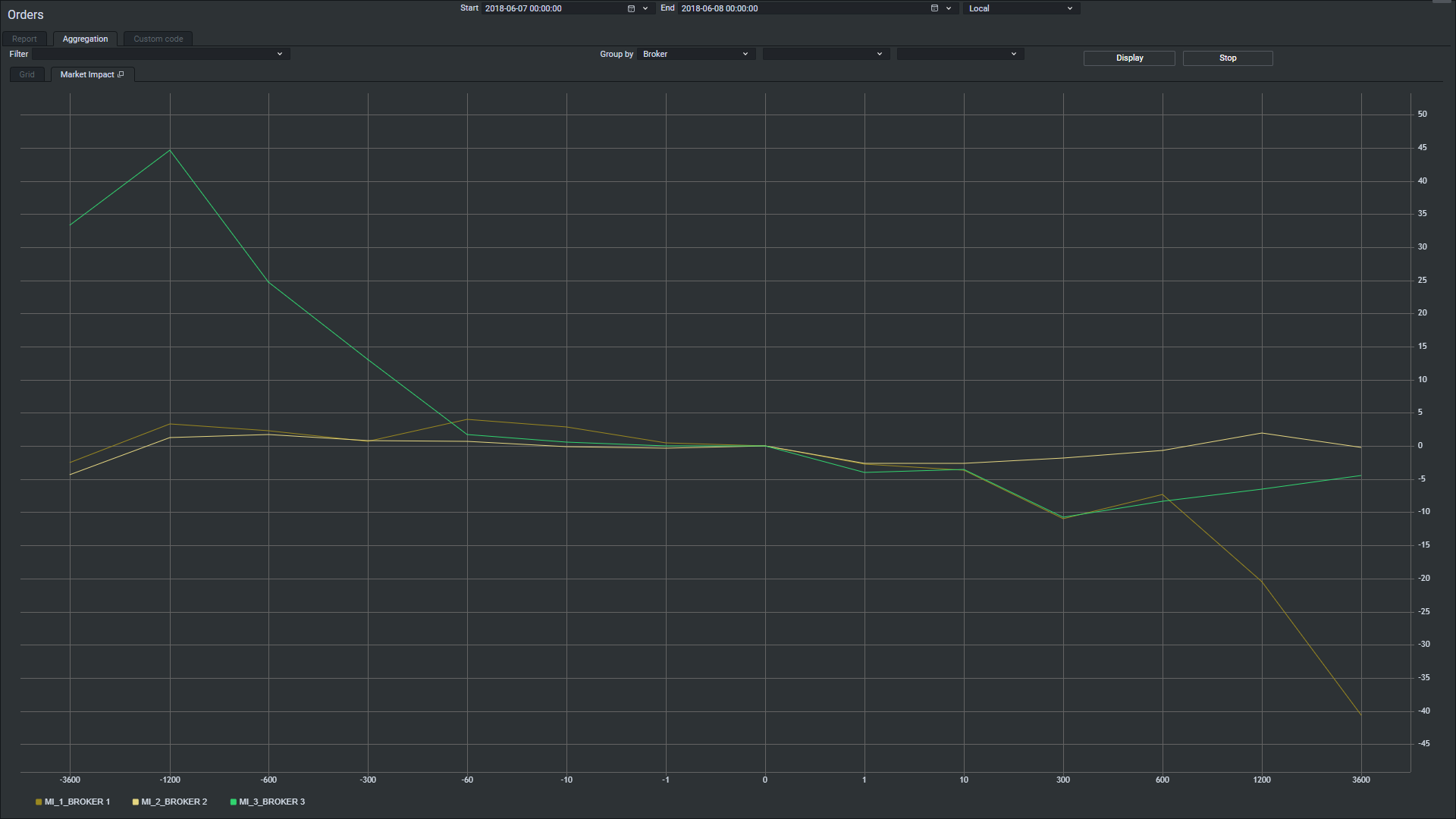

Use Cases

OneMarketData

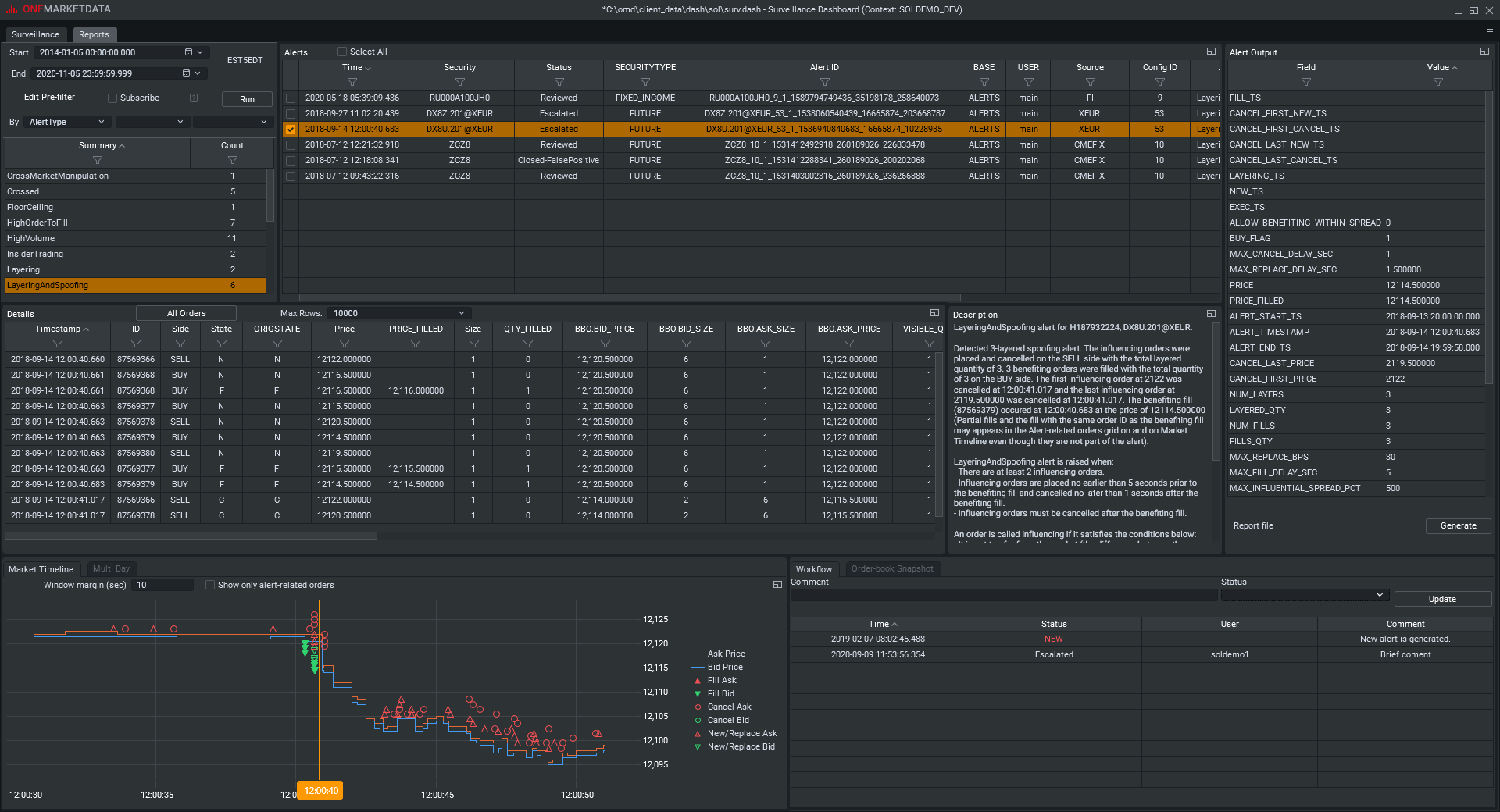

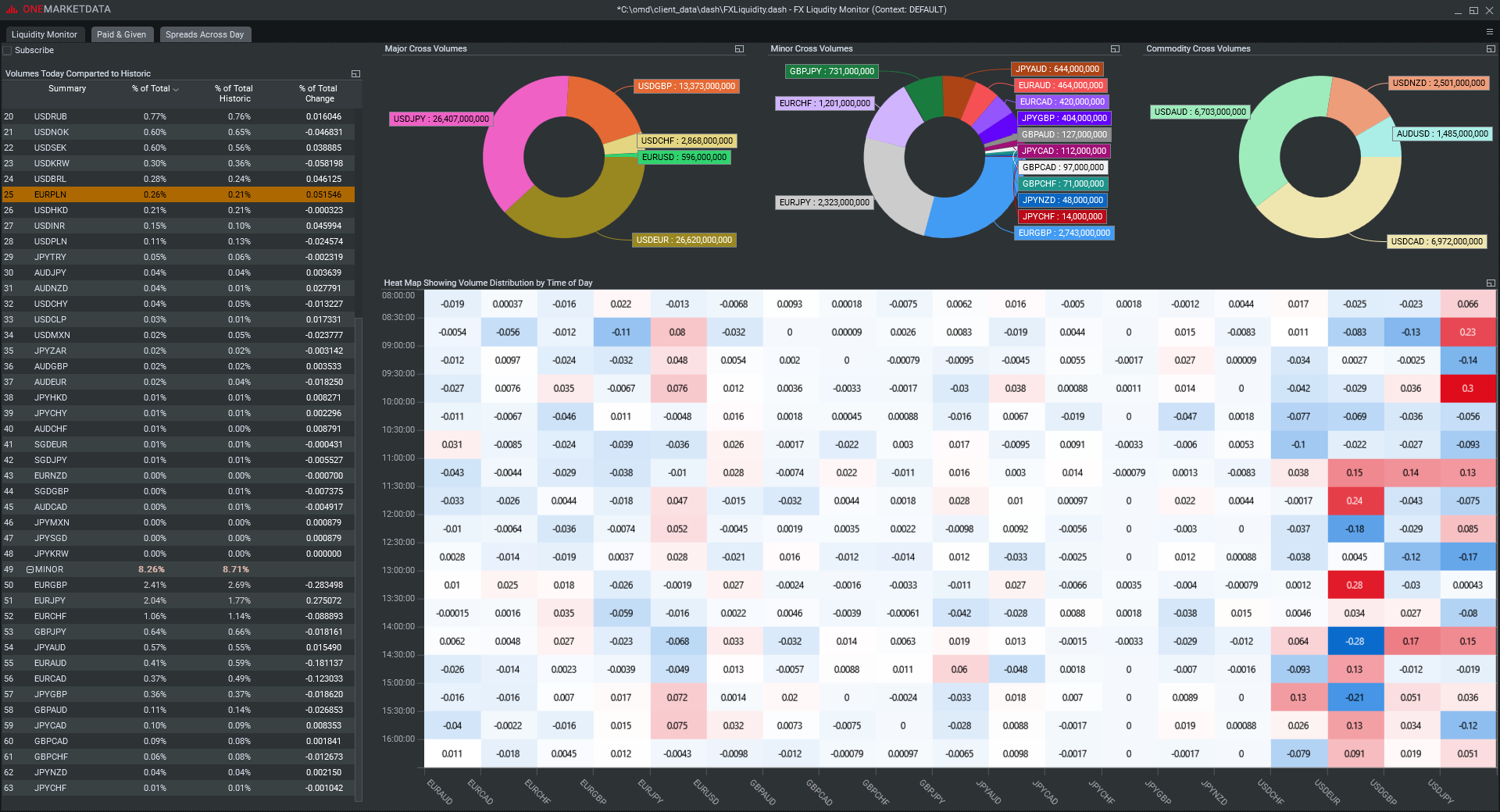

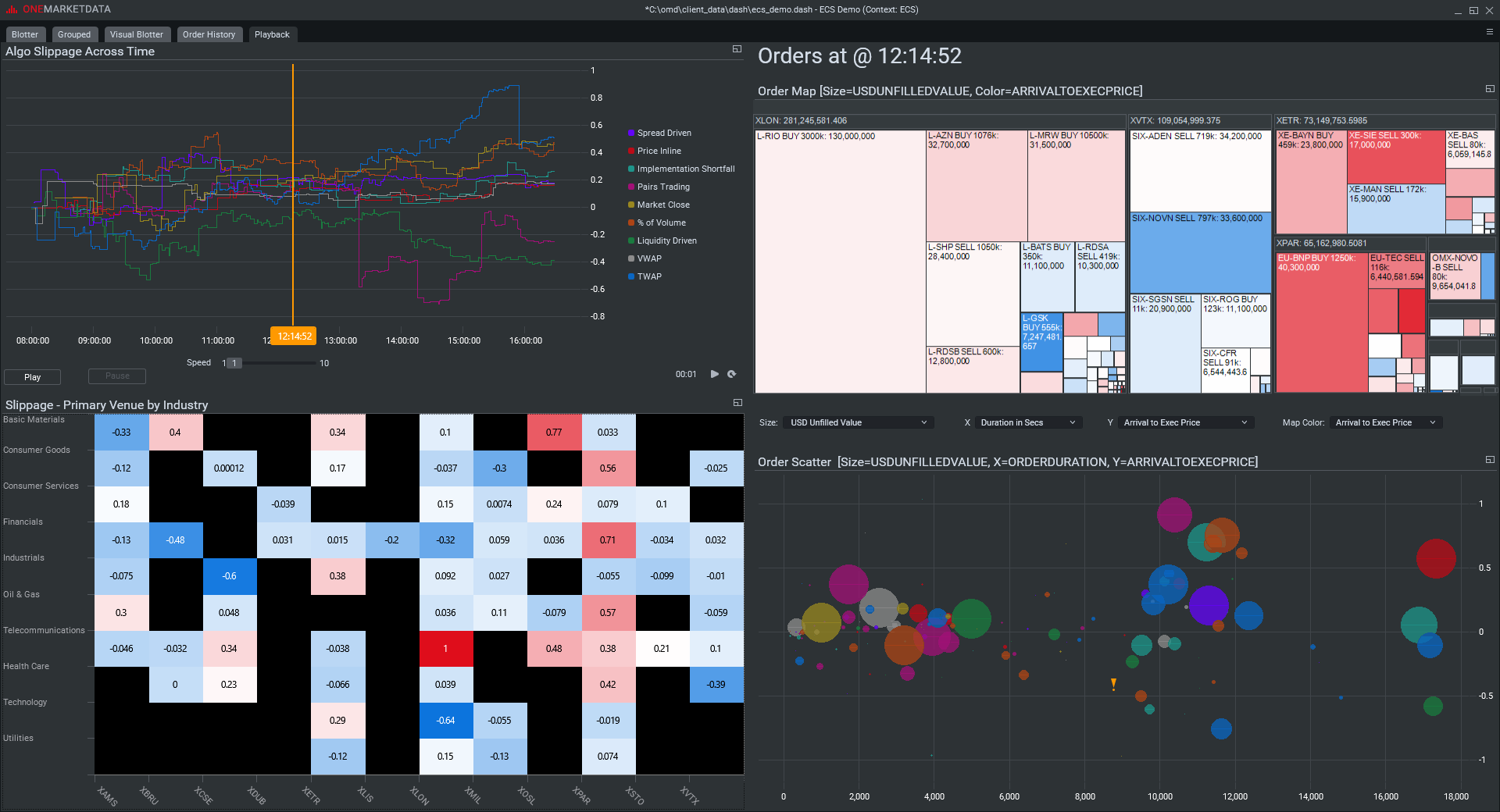

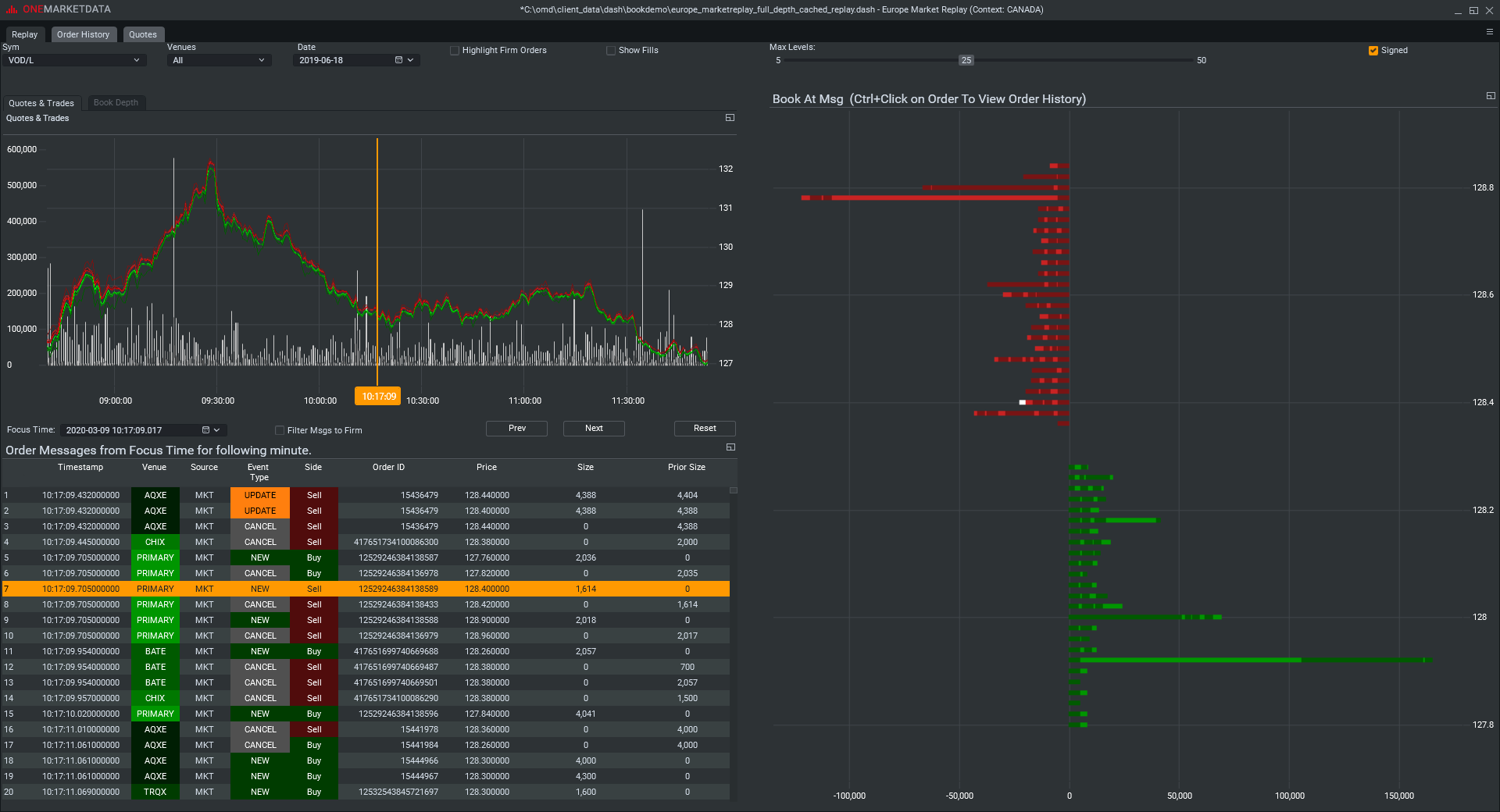

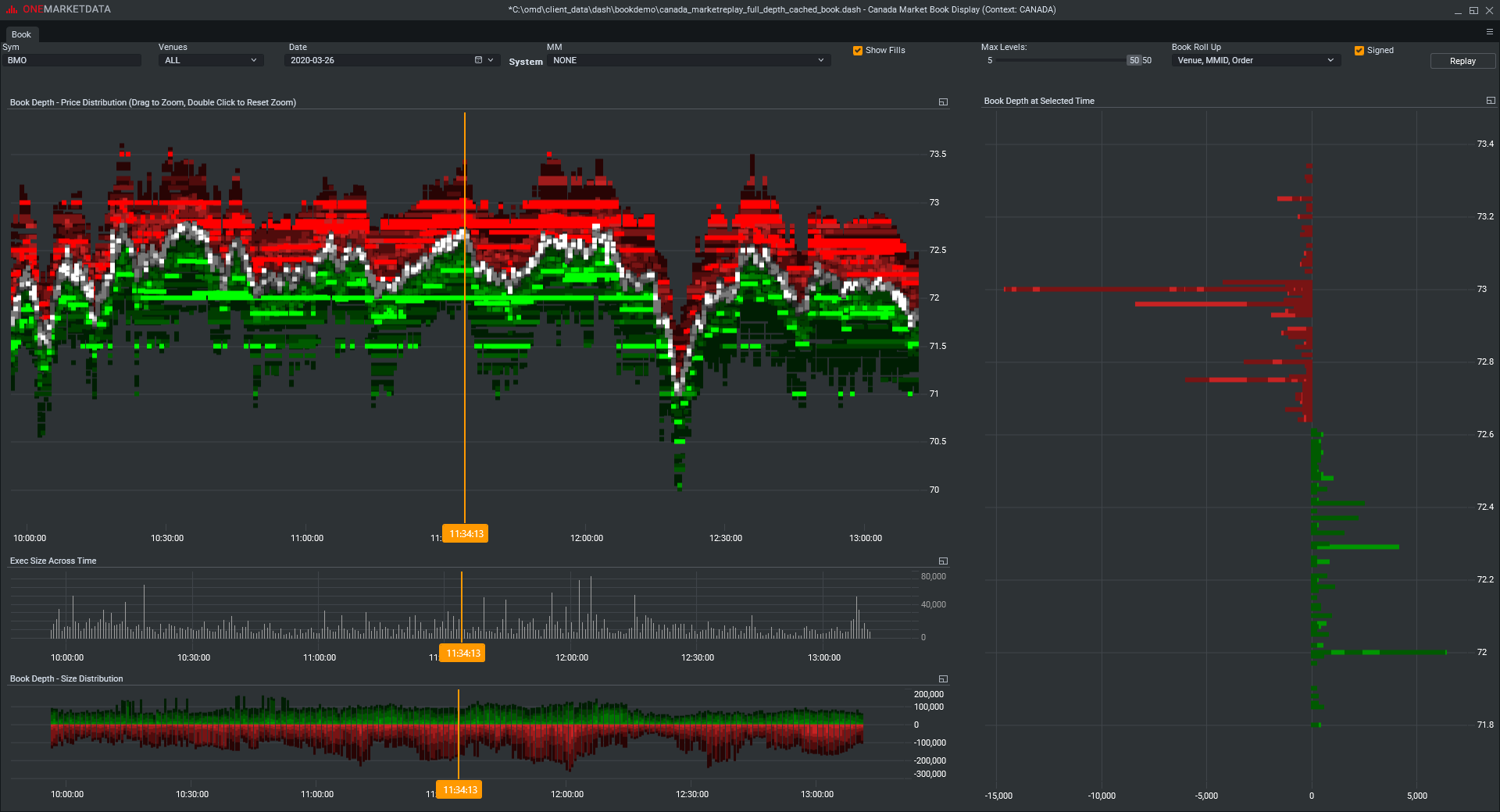

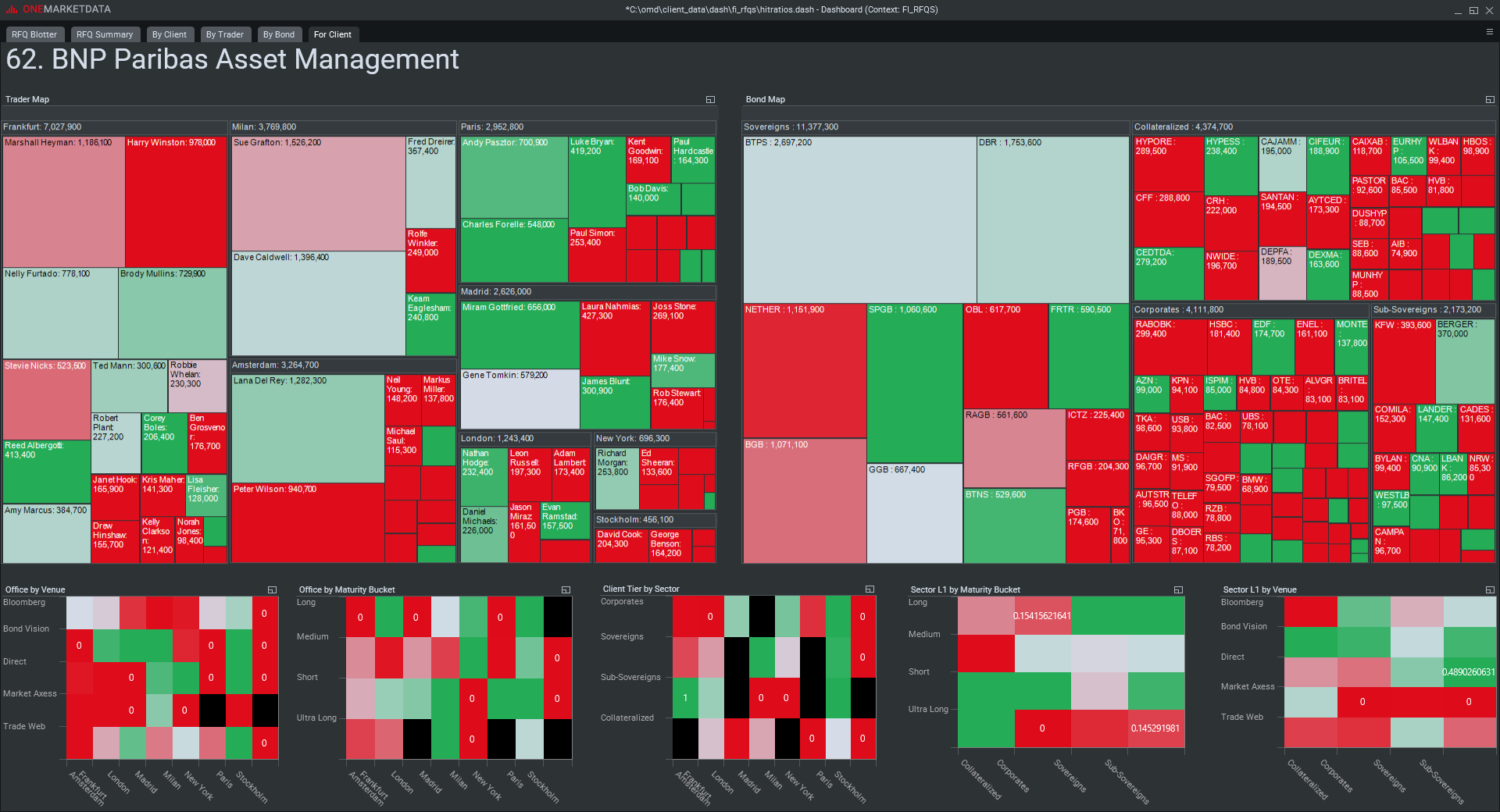

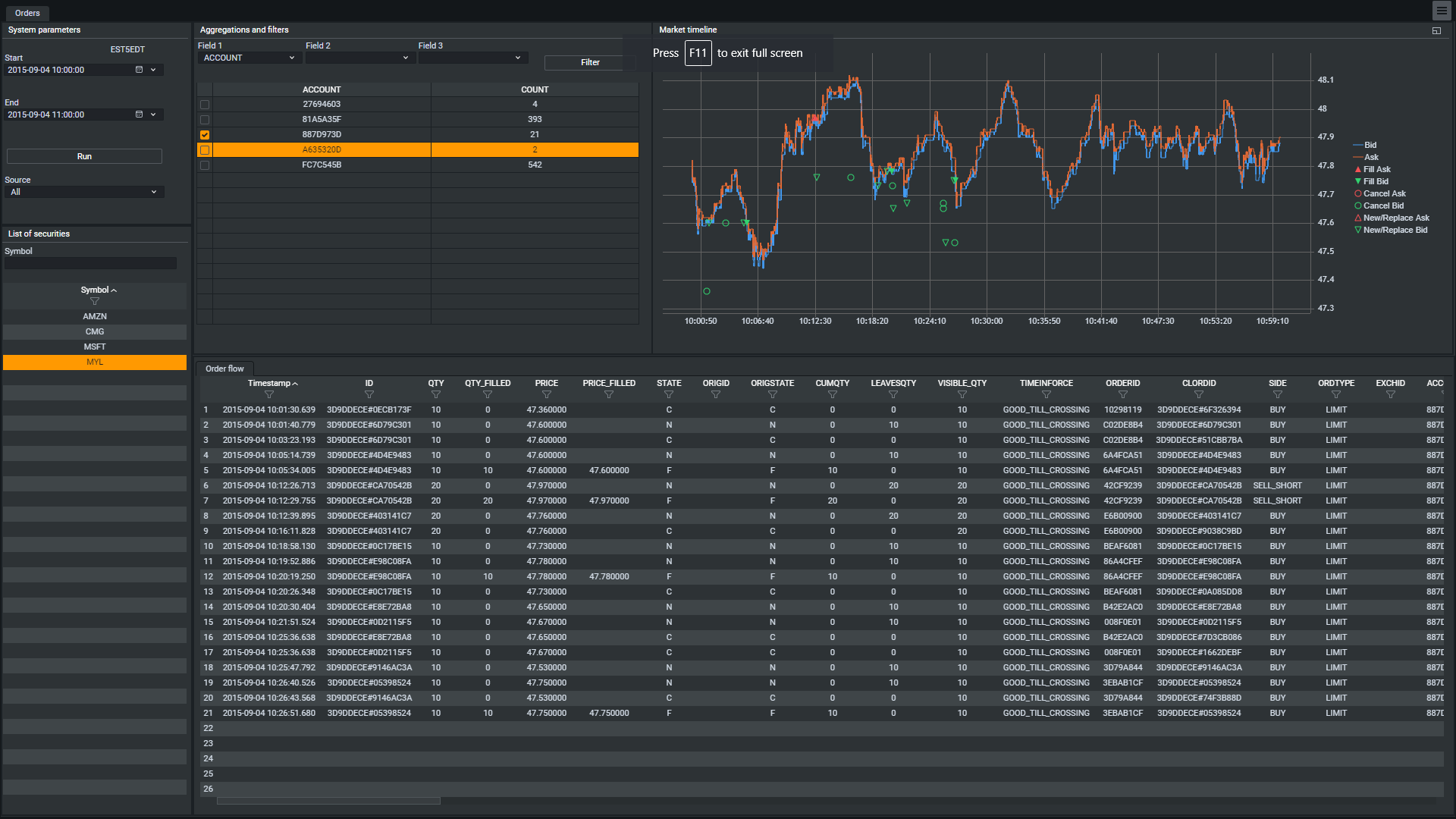

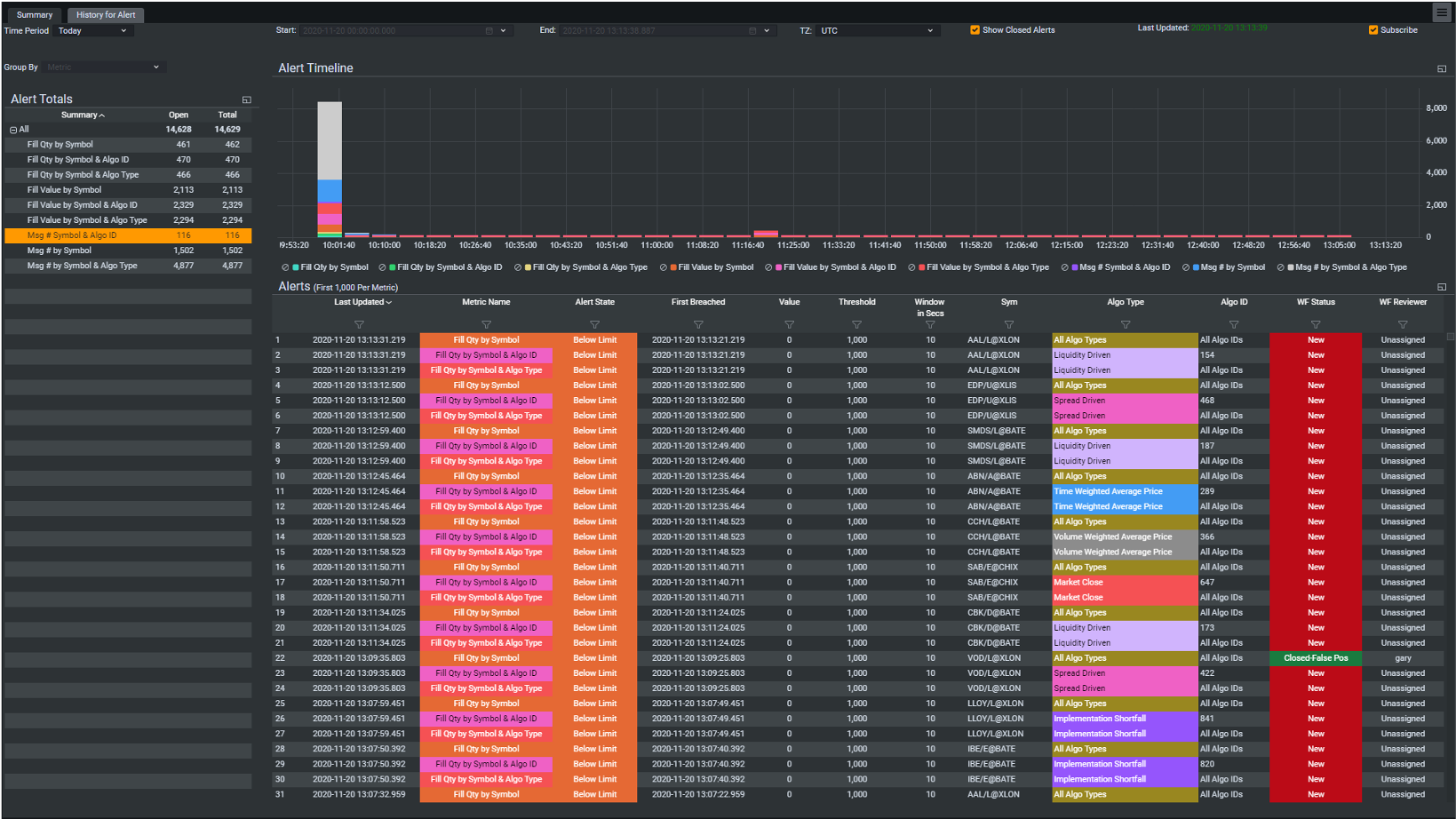

TRADING ANALYTICS, MARKET DATA AND SURVEILLANCE

Built by Wall Street experts, the OneTick suite offers enterprise technology to address the most demanding requirements.

Proprietary traders, hedge funds and investment banks can leverage the built-in capabilities of OneTick for quantitative research, transaction cost analysis, surveillance and back-testing.