Crypto trade surveillance

OneMarketData

Be Ready for Change

Improve your trading insights and transparency

Benefit from OneTick's experience in Data, Analytics and Trade Surveillance for your Crypto Trading.

OneTick Crypto Solutions

Rebuild Order Books

Analyze Trade Data

Embrace the Future of Crypto Market Monitoring

Enhance your trading insights and transparency with OneTick. OneTick can be used to provide analytics to rebuild crypto order books, join trades to prevailing market prices, calculate performance metrics, and generate trading signals. Leverage the built-in OneTick analytics to first rebuild the order book down to a certain number of levels, and then output it either as a running book or output it periodically: every second, every five seconds, or just at a particular point in time. You also have the power to analyze trade data from multiple exchanges, looking at multiple coins and tokens over time. When exploring this data, you can step through by hand or automate analyses to run continuously at your desired interval, whether that be month by month, week by week, or minute by minute. You can also export your trade data on file and explore the detailed summaries. With OneTick, you have the power to choose the data dimensions you want using our comprehensive filters to help you better navigate your data. Benefit from OneTick's expertise in Data, Analytics, and Trade Surveillance for optimized trading outcomes.

Best Practices for Analytics Crypto Markets

Learn the best practices of analytics and how they can be applied to crypto markets

Watch the Webinar

OneTick Crypto Solutions

Powerful Analytics

Data Explorer

Mastering Crypto Market Monitoring with OneTick

Leverage the powerful analytics with OneTick when consuming and processing crypto pricing data. OneTick is a tick analytic platform that provides all the building blocks to create trading analytics for your crypto trading activities, so that you can focus on trading.

Complex trading requires trading analytics of the full market; you can’t just look at the top of the book and back-test across historical data. You have to go down the book and accumulate statistics. OneTick empowers you to do exactly that. Use OneTick to collect trades, order books, and order book messages for select instruments across selected venues, then load that data into memory databases to make it available for querying. Live analytics as new subscribed data appears. Data is available for historic and intraday querying and for string processing.

OneTick isn't just a tick collection platform. OneTick can be used to provide analytics to rebuild crypto order books, join trades to prevailing market prices, calculate performance metrics, and generate trading signals. OneTick's powerful analytics enables the rebuilding of crypto order books, joining trades to prevailing market prices, calculating performance metrics, and trading signals for effective market monitoring. Utilize the built-in OneTick analytics to reconstruct the order book down to a specific number of levels, and output it as a running book or periodically.

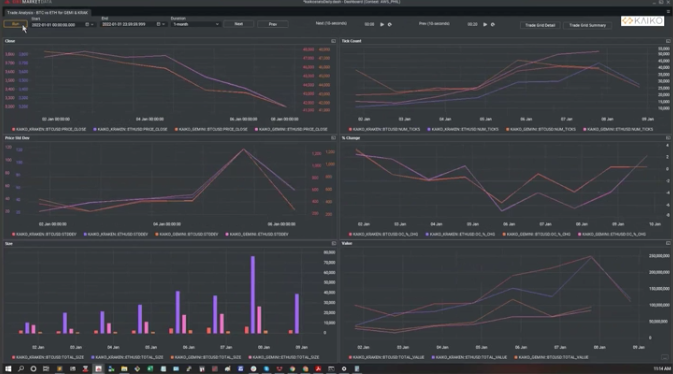

Trade data broken down day to day, month by month, as seen above.

Trade data broken down day to day, month by month, as seen above.

Trade Surveillance

Order Flow Performance

Extract Value from Data and Monitor Multiple Markets

OneTick's potent analytics allows for seamless consumption and processing of crypto pricing data, making it an invaluable tool for market monitoring. As a tick analytic platform, OneTick provides all the building blocks necessary to create trading analytics for your crypto trading endeavors, so you can concentrate on trading.

With OneTick, you have access to fully attributed data history, allowing you to easily investigate anomalous participant behavior down to the nanosecond or zoom out for a broader view of the entire day's activities. In the reals of market monitoring, all orders flowing through the matching engine are captured, with each order associated with a specific market participant and instrument, and progressing through the placement to partial fill, fill, or cancel lifecycle. Once it is stored, this fully attributed order flow, with the layered surveillance capabilities on top, empowers our customers with automatically generated alerts when a participant's flow breaches specific criteria and a clear map to the moment when executions occurred.

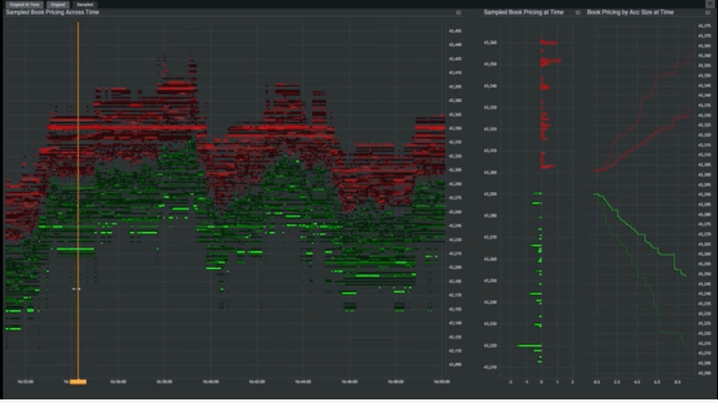

OneTick allows you to rebuild the market and step back through time, replaying the specific market activity across a specific alert. Or, you can always look back across the whole day, then zoom down to a small sub-second time window. You have the power to recalculate the full depth at each point in time, event by event, and back across the day; or you can focus in on a specific number of price levels, size, or price skew. As the order flow is fully attributed, we can group order flow by participant and calculate the specific performance statistics across defined time windows. Whether it's simple counts of event frequency or more complex position participation, transaction costs and PNL calculations, we have the data so we can build the calculations.

Order book examined across a 2 hour window

Order book examined across a 2 hour window

Optimized for

Crypto Data

Optimized for Crypto Market Monitoring

OneTick addresses the distinctive differences in order sizes and prices in crytocurrencies, making in an ideal choice for market monitoring. Unlike traditional markets, crypto order sizes are not integers and prices can be more granular.

To handle these unique crypto data challenges, OneTick configures its book processing to determine the size of crypto orders by redefining databases, normalizing records, updating query designer arguments, and redefining new variables or fields as doubles, not integers. For price adjustments, OneTick supports a special type called decimal, a 128-bit floating-point number, providing a comprehensive market monitoring solution.